As an employer, you must stay on top of your payroll responsibilities, including federal, state, and local taxes and deductions. If you are an employer with employees who work in Washington state, you need to know about the Washington paid family leave program.

What is the Washington paid family leave program?

The Washington paid family leave program provides paid time off employees can use to deal with family- or medical-related life events.

Under the paid family leave program, employees can take up to 12 weeks of paid time off if they have a baby or adopt, become ill or injured off the job, or need to care for an ill or injured family member. Employees with more than one qualifying event may qualify for up to 16 weeks. Employees with a condition in pregnancy or birth that results in incapacity can receive up to 18 weeks. Washington’s Paid Family and Medical Leave does not replace the federal Family and Medical Leave Act (FMLA).

Employees can take Paid Family and Medical Leave after working at least 820 hours during the qualifying period. Eligible employees receive a percentage of their average weekly wage, up to an annual maximum.

Employees must pay into this program to use benefits. Employers must withhold the Washington Paid Family and Medical Leave premium from the wages of employees who primarily work in Washington. Only federal employees are exempt from the program. However, not all employers are required to contribute to the program.

Employers with fewer than 50 employees who work in Washington during a year do not have to pay the employer portion of the premium. The state of Washington calculates the number of employees you have per year each September by taking an average from the past four quarters. Washington does not use full-time equivalent employee calculations.

If you are self-employed, you can opt into the Paid Family and Medical Leave program. You must pay both the employer and employee share to receive benefits. Opting into the program locks you in for three years, and one year thereafter.

Voluntary plan alternative

Some employers prefer to run their own paid family leave programs. You can apply for a voluntary plan. Keep in mind that all employers with employees who work in Washington must follow the state paid family leave program or apply for a voluntary plan.

Contribution rates

The Washington paid family leave contribution is a flat rate of 0.92%, shared by employees and employers who have 50+ employees. Employees contribute 71.52% of this 0.92% contribution rate and employers pay 28.48% when they are liable.

Employers can pay both the employer and employee premiums to simplify calculations and reduce employee deductions.

Like Social Security tax, the Washington paid family leave contribution has a taxable wage base. What is a wage base? A wage base means you will collect and contribute the Washington premium until the employee earns a certain amount.

The Washington paid family leave premium’s annual cap is the same as the Social Security wage base. Once an employee earns above the wage base, stop withholding and contributing.

Do not withhold more from employee wages than the employee portion. If you did not withhold enough from employee wages throughout the quarter, you are responsible for paying the rest of their liability.

If you are not required to contribute the employer rate, only withhold the employee rate of 71.52% (for 2025) of 0.92%. You can elect to pay the employee’s premium on their behalf.

The state requires that you first multiply the employee’s wages by the total flat rate of 0.92% (for 2025) and further break down the employee and employer portions from there.

Computing the employee and employer portions of the Washington paid family leave premium is tricky. Rounding can be complicated when calculating rates, so check out the example below to learn how to properly calculate the WA premium. And, take advantage of Washington’s online calculator to estimate taxes.

Withholding and contributing example

Let’s say an employee earns $2,000 in gross wages biweekly. Use the three steps below to break down the employee and employer contribution rates.

1. First, calculate the total employee and employer contribution amount. Multiply the employee’s biweekly wages by the 2025 rate of 0.92%.

$2,000 X 0.0092 = $18.40

2. Use the $18.4 to calculate the employee’s contribution portion of 71.52%. This is the amount you will withhold from the employee’s wages.

$18.40 X 0.7152 = $13.16

The employee’s premium is $13.16 split between family leave and medical leave.

3. If you are required to pay the employer portion, calculate your premium liability, of 28.48% (for 2025) of the total $18.40.

$18.40 X 0.2848 = $5.24

You must withhold approximately $13.16 from the employee’s wages and contribute the employer premium of $5.24

Financial assistance for employers

Some small businesses may receive state grants up to $3,000 if they hire a temporary worker to replace an employee on Paid Family and Medical Leave. To see if you are eligible, consult Washington’s government website.

Remitting withheld WA paid family leave premiums

You are responsible for reporting employee wages, withheld premiums, and contributed premiums (if applicable) and remitting premiums to the state. Failing to report can result in penalties.

Submit Washington paid family leave premiums separately from your state unemployment insurance funds.

You must include your business’s name, Unified Business Identifier (UBI) number, total premiums collected, and your name on the report. Also include each employee’s Social Security number, name, hours worked, and wages earned during the quarter.

Filing and payment due dates

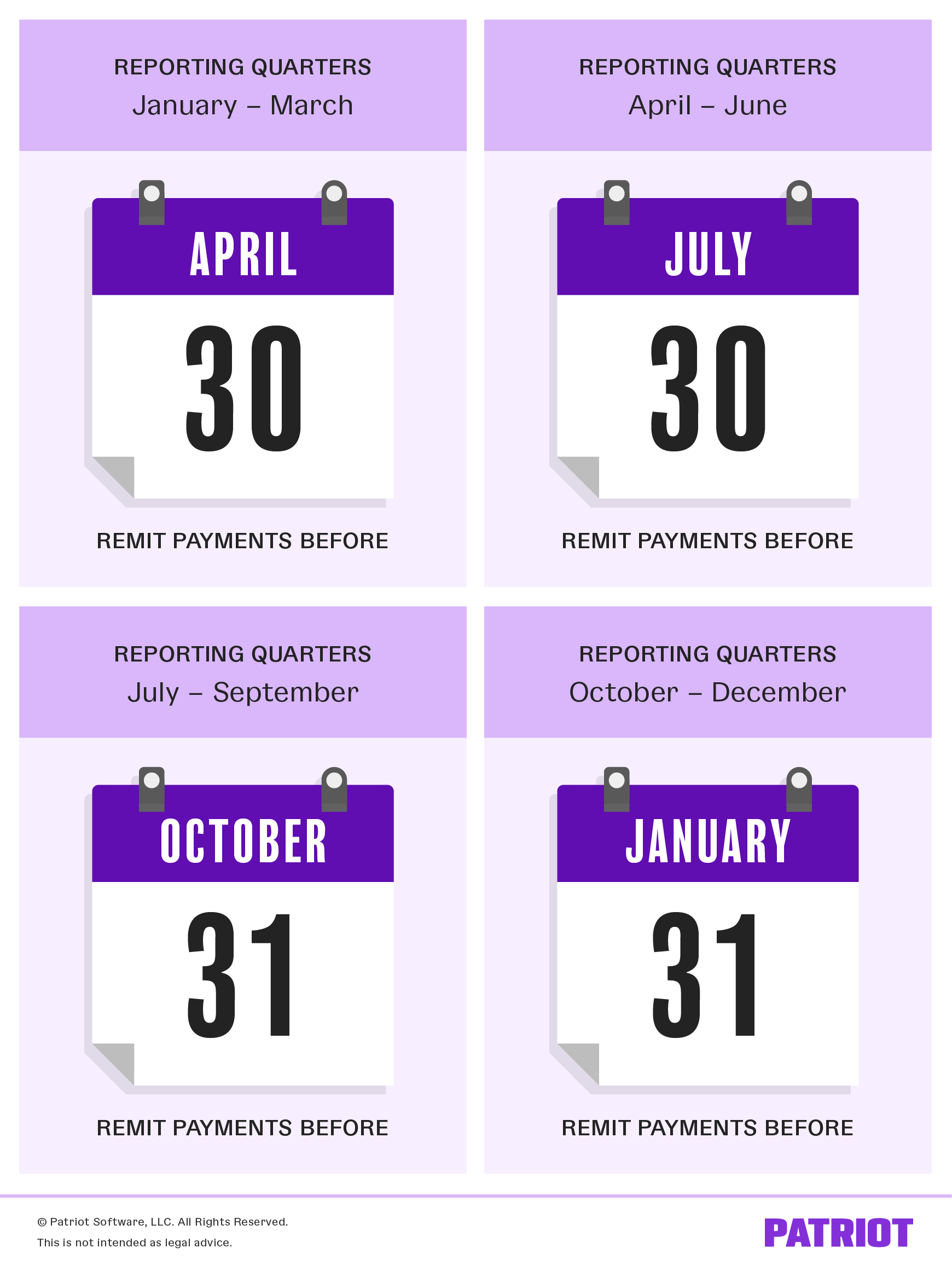

You must report and remit paid family leave premiums quarterly. Take a look at the following chart to learn your reporting and payment due dates:

Washington state paid family leave at-a-glance

If you feel overloaded with information, check out these fast facts about the Washington paid family leave program:

- Premiums cover up to 12 weeks of paid time off when employees have a baby or adopt, deal with a serious illness or injury, or must care for an ill or injured family member

- Employees can access benefits after working 820 hours

- The total contribution rate for 2025 is 0.92%, split between employees (who pay 71.52% of the rate) and employers with 50+ employees (who pay 28.57% of the rate)

- Employers must withhold and remit employee premiums

- Employers with fewer than an annual average of 50 employees do not need to pay the employer portion

- Report and remit contribution amounts quarterly

- Self-employed individuals can opt into the program

Computing the new Washington paid family leave premium can be tricky. With Patriot’s online payroll software, you don’t need to worry about calculating contribution amounts. Why make payroll more difficult than it needs to be? Get your free trial today!

This article has been updated from its original publication date of December 5, 2018.

This is not intended as legal advice; for more information, please click here.