As an employer, you can offer various benefits to your employees. There are pre-tax and post-tax benefits for employees to enjoy. One plan you can offer employees is a health, or medical, FSA. So, what is an FSA?

Interested in offering employees a flexible spending account? Read on to learn about qualifying expenses, 2025 FSA contribution limits, and more.

What is an FSA?

An FSA, also known as a flexible spending account (or arrangement), is a tax-free fund that employees can contribute to and use on qualifying costs. There is an annual IRS contribution limit on FSAs.

There are a few types of FSAs, including:

- Health FSAs: Employees can use funds on qualifying medical and health care expenses (e.g., prescriptions).

- Dependent care FSAs: Employees can use funds for qualifying dependent care services (e.g., daycare).

FSAs are voluntary benefits you can offer in your business. Likewise, employees can choose to contribute to an FSA plan. You must establish an FSA at your business for employees to open accounts. Self-employed individuals are not eligible to have an account, and highly compensated employee restrictions also exist. An FSA is a qualifying benefit under a Section 125 plan, or cafeteria plan.

Health FSAs are the most common type of flexible spending arrangement. You can offer FSA plans to employees as a standalone benefit or in conjunction with traditional health insurance or high-deductible health plans. But, health FSAs aren’t the only type of savings accounts employees can use for health and medical expenses. You may also consider setting up an HSA (health savings account).

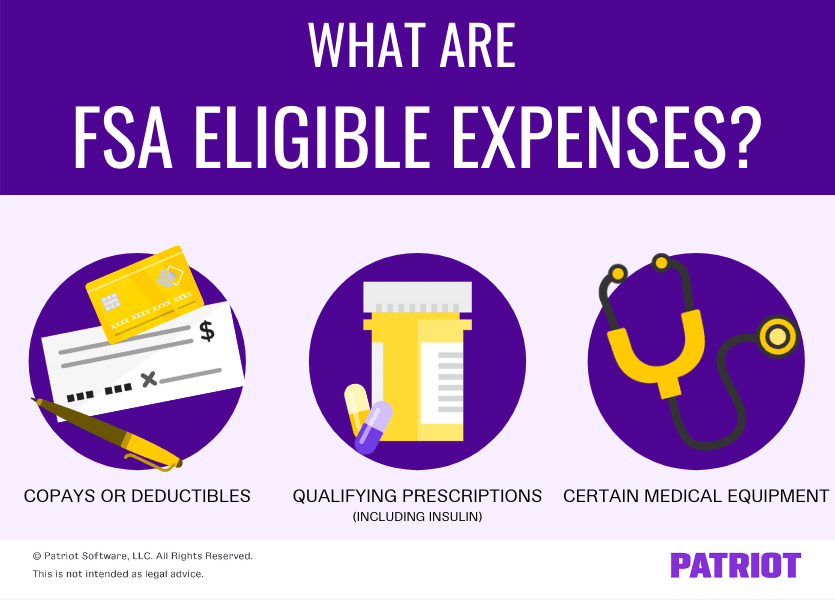

What can employees use FSA plans on?

You must specify qualifying medical expenses in the FSA plan you establish. Employees can pay for qualifying medical and dental expenses with their FSA funds.

FSA eligible expenses include the following:

- Copays or deductibles

- Qualifying prescriptions

- Certain medical equipment

Different procedures or situations that let employees use their funds include an ambulance, physical examination, psychologist, or operation.

Medicines or drugs qualify as medical expenses if they require a prescription, are over-the-counter medicines that are prescribed, or are insulin.

FSA-eligible items also include things like bandages, crutches, or artificial teeth.

The employee, their spouse, dependents, or child under the age of 27 can incur medical expenses.

For a full list of qualifying medical expenses, consult the IRS’s Publication 502.

Heads up! Insurance premiums do not count as FSA qualifying expenses.

Do employers have to contribute to FSAs?

You can choose to contribute to an employee’s FSA plan. Employer contributions are not mandatory.

If you do contribute, do not include employer FSA contributions in the employee’s gross income.

2025 FSA contribution limits

Each year, the contribution limit for an FSA plan changes. For 2025, employees can contribute up to $3,300 per year to their account, up from the 2024 limit of $3,200.

Are FSA plans taxable?

Contributions to FSA plans are made on a pre-tax basis. Pre-tax contributions mean you take money out of employee wages before withholding taxes. This reduces the employee’s tax liability.

For example, an employee earns $1,200 with each paycheck. They contribute $35 to their FSA plan. The employee’s taxable wages are only $1,165 ($1,200 – $35).

When does an employee determine their contribution amount?

The employee determines how much to contribute to the account during open enrollment. You must withhold their contribution amount from their wages each pay period for their FSA plan.

If the employee has a qualifying life event (e.g., marriage, divorce, birth of a child), they can change their contribution amount during the year. Otherwise, they are generally stuck with the amount they decided during open enrollment.

When does an employee have access to funds?

The employee has access to the full amount they plan on contributing instantly, regardless of whether or not they have contributed that amount.

For example, an employee decides to contribute $2,000 to their flexible spending account throughout the year. It’s February, and the employee needs $500 from their FSA plan. So far, you’ve only withheld $80 from their wages for the account. However, the employee has full access to the $2,000. So, they can take $500 to cover their expense (hooray!).

How do employees receive distributions from their account?

Employees can typically either use an FSA debit card to pay for qualifying expenses or receive reimbursements for eligible costs.

Can employees carry money over?

For the most part, the money in an FSA plan is forfeited back to your company when the year ends. However, there are two optional FSA carryover rules you can choose from to offer employees:

- Grace period: Your FSA plan can offer a 2.5-month grace period after the plan year. The employee can use the funds if they have medical expenses within the grace period. After the 2.5 months end, the employee loses the remaining balance, and the FSA forfeiture goes to your business.

- Carryover: You can include a carryover condition that lets employees add up to $660 of unused funds to the next year’s plan ($660 is the 2025 limit; $640 is the 2024 limit). You decide the carryover limit. Any amount over the carryover limit is forfeited to your business.

Are there reporting requirements?

Employees do not need to report FSA contributions or distributions on their tax returns. This differs from an HSA or Archer MSA, which requires the employee to report the contributions on Form 1040.

For more information on FSA plans, consult the IRS’s Publication 969.

Benefits of an FSA

So, what’s the big deal about establishing a medical FSA plan in your business? Through an FSA, you can:

- Enjoy tax savings

- Attract candidates to apply

- Increase job retention

Having an FSA can provide a tax benefit to both you and your employees. Employees reduce their federal income tax and FICA (Social Security and Medicare) tax liability. Hooray for them, and hooray for you, too. FICA tax consists of employee and matching employer portions. Because an FSA plan reduces the employee’s taxable wages, you and the employee pay less in FICA taxes. But, keep in mind that employee FSA contributions may still be subject to state and local income tax withholding, if applicable.

Small business employee benefits are important to many workers, attracting candidates to a job and improving retention rates.

Want a better method to keep track of payroll details for your employees? Patriot’s online payroll software offers an easy way to withhold taxes, benefits, and other deductions from employee wages. And, we offer free setup and support. Get your free trial today!

This article has been updated from its original publish date of September 28, 2011.

This is not intended as legal advice; for more information, please click here.