Every small business makes payments to operate. Some of these payments must be reported to the IRS or Social Security Administration (SSA). Companies must use information returns to report qualifying payments. Do you need to file an information return?

Learn what information returns are, which common forms small businesses might need to file, and how to file returns correctly.

What is an information return?

An information return is a mandatory form that third parties (e.g., businesses, health insurance providers, financial institutions, and universities) use to notify government agencies and taxpayers about taxable payments. Small companies can send a variety of information returns, such as Forms 1099-NEC and W-2. Submitting these forms makes it possible for agencies like the IRS and SSA to track an individual’s tax liability.

Information returns show how much someone was paid during the calendar year. Individuals and businesses use the information reported on information returns to file their tax returns correctly.

As a small business owner, you must file information returns when you make certain payments, including both employee and nonemployee compensation. And, remember to keep a copy of each information return for your records.

Common types of information returns for small business

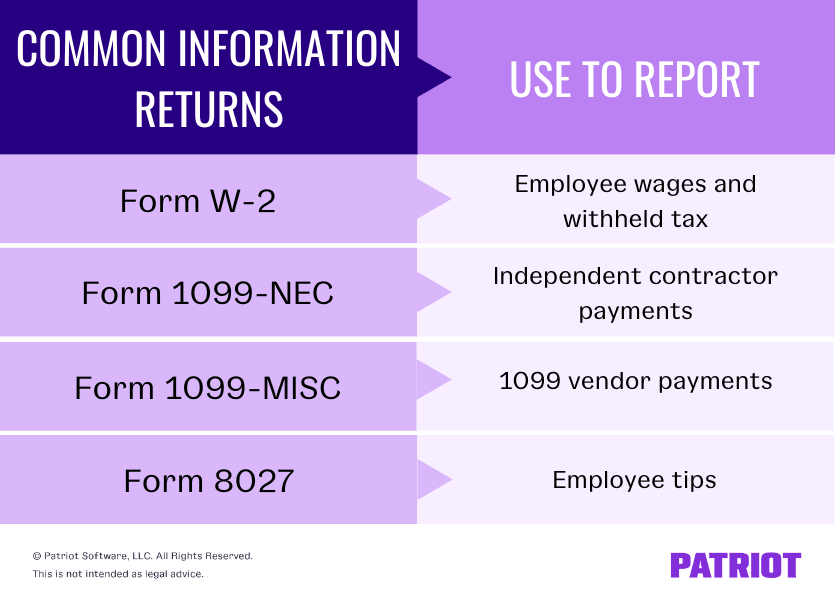

There are dozens of information returns to report everything from education expenses to stock transfers. But for small businesses, the following annual information returns are the most common:

- Form W-2

- Form 1099-NEC

- Form 1099-MISC

- Form 8027

You must file Form W-2, Wage and Tax Statement, if you have employees. Form W-2 lists how much you paid an employee and withheld from their wages for taxes.

For nonemployee compensation, you need to file Form 1099-NEC, Nonemployee Compensation. If you hire independent contractors, report their wages as nonemployee compensation.

If you make payments to 1099 vendors, you must file Form 1099-MISC, Miscellaneous Information.

When your employees earn tips, you may be required to file Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips. This information return reports how much employees earned in tips.

For a full list of IRS information returns, visit the IRS’s website.

How to file information returns

Failing to file information returns can result in penalties and fines. File accurate and timely information returns to comply with your small business owner responsibilities.

Filing information returns electronically is the IRS- and SSA-preferred method. If you have 250 or more information returns, you are required to file electronically with the IRS or SSA.

Information returns are generally due in the beginning of the year, with due dates including January 31st, February 28th, and March 31st.

Exact filing methods and due dates vary between information returns. Keep an eye out for due date extensions, too.

Form W-2

You must send Form W-2 to the Social Security Administration, the employee, and any applicable state government.

You can file Form W-2 with the SSA electronically or through the mail. When you file this information return, you must also send Form W-3, Transmittal of Wage and Tax Statement. Form W-3 summarizes your Forms W-2.

Send Forms W-2 and W-3 by January 31 to employees and the SSA.

Form 1099-NEC

If you paid an independent contractor $600 or more during the year, send Form 1099-NEC to the IRS, independent contractor, and any applicable state tax department. You can file Forms 1099-MISC electronically using the IRS’s Fire System or IRIS, or by mailing them to the IRS.

When you send Form 1099-NEC in the mail, you also need to file Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Send Forms 1099-NEC and 1096 by January 31 to independent contractors and the IRS.

Form 1099-MISC

You must file this information return if you make other 1099 payments, such as rent payments, medical and health care payments, or payments to an attorney.

Like the 1099-NEC, send the form’s copies to the vendor, IRS, and any applicable state tax department.

Form 1099-MISC is due to the recipient by January 31 and the IRS by February 28 (paper) or March 31 (electronically).

Form 8027

Send Form 8027 to the IRS annually. You can file electronically through the IRS’s FIRE system, which is the IRS’s preferred filing method. Or, you can mail the form to the IRS.

If you file Form 8027 electronically, the due date is March 31. However, Form 8027 is due by February 28 if you mail it.

When you have employees, you need to file information returns. Maintain accurate payroll records with Patriot’s online payroll software. Our software makes it easy to run payroll and access paycheck history information. Plus, we offer free setup and support. Get your free trial now!

This article has been updated from its original publication date of June 15, 2012.

This is not intended as legal advice; for more information, please click here.