Step 1: Land the contract for a federal government-funded job. Step 2: Comply with your certified payroll reporting requirements. What is certified payroll?

Contractors and subcontractors working on federally funded construction projects have an additional payroll responsibility known as certified payroll. You must complete and send certified payroll reports to the government to avoid penalties like fines and imprisonment.

Here’s what you need to know to stay compliant.

What is certified payroll?

Certified payroll is a weekly payroll report that discloses employee hour and wage information to the government. Certain government contractors and subcontractors must complete certified payroll reports.

The government uses these special certified payroll reports to verify that contractors and subcontractors pay employees fairly.

Who does certified payroll apply to?

Businesses with a federally funded or assisted contract of over $2,000 for the construction, alteration, or repair of public buildings or public works to complete certified payroll reports. You must also use a weekly pay frequency.

The certified payroll requirements apply to both contractors and subcontractors.

| Do You Need to Complete a Certified Payroll Report? |

|---|

| You must handle certified payroll reporting if you answer YES to both of the following: 1. You are a contractor or subcontractor on a federally funded or assisted project. 2. The contract is over $2,000 for the construction, alteration, or repair of public buildings or works. |

Which law requires a company to use certified payroll?

The Davis-Bacon Act (DBA) is the labor standard that requires contractors and subcontractors to use certified payroll.

DBA requires contractors and subcontractors with a construction-related federal contract of over $2,000 to pay employees the prevailing wage. The U.S. Department of Labor determines the prevailing wage.

Do you have a contract over $100,000? The Davis-Bacon Act requires contractors and subcontractors with contracts of over $100,000 to pay laborers and mechanics overtime for all hours worked over 40 in a workweek. Keep in mind that overtime rules may apply to your business under the Fair Labor Standards Act even if your contract is under $100,000.

What are prevailing wages?

A prevailing wage is the rate for wages and fringe benefits (e.g., health insurance) that businesses with government contracts must pay employees. The prevailing wage varies by location.

The Department of Labor uses the average wages that employees in the area with similar roles receive to set the prevailing wage rates by location.

You should be able to find the prevailing wage in your contract. If you do not know the prevailing wage rate, contact your funding agency (i.e., the federal agency paying your contract) or the Department of Labor.

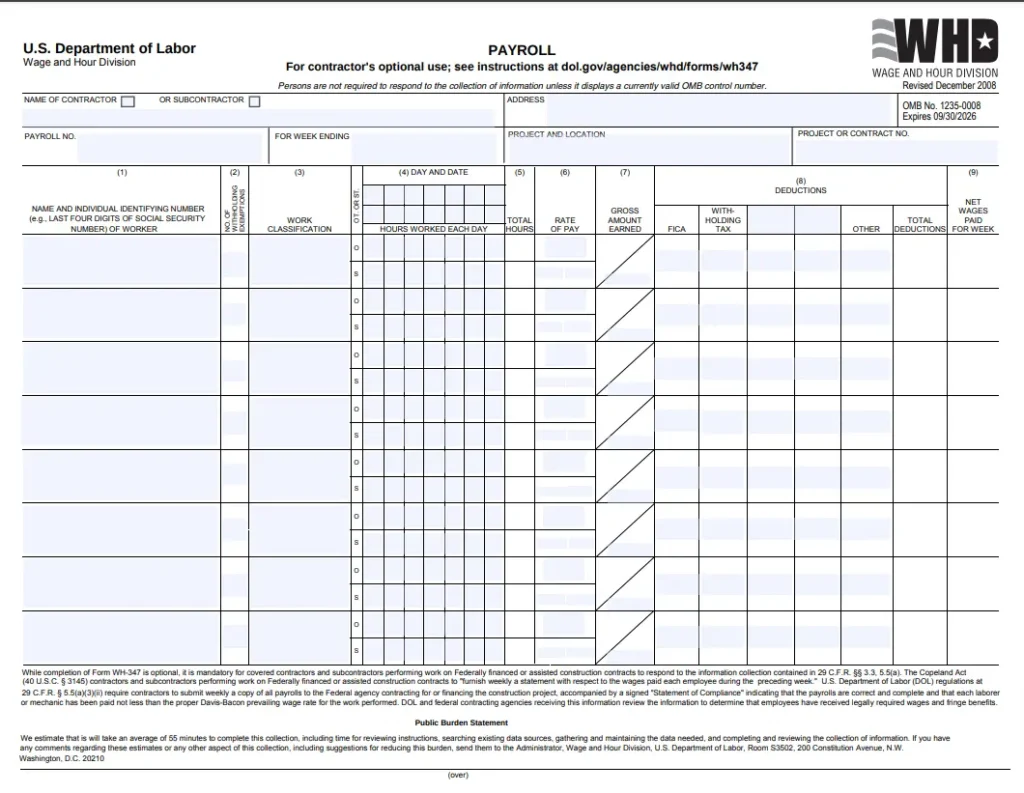

How to do certified payroll: Fill out WH-347

Contractors and subcontractors with federal contracts can fill out Form WH-347 each week to satisfy certified payroll reporting requirements. Form WH-347 is an optional payroll report from the U.S. Department of Labor that fulfills your certified payroll reporting requirements.

Report information about your business, your employees, and how much you pay employees on the WH-347, including:

- Business name, address, and whether you are a contractor or subcontractor

- Project and location information

- Employee names and Social Security numbers

- Employee hours worked, pay rate, gross wages, deductions, and net pay

The government requires certified payroll information to verify federal contractors and subcontractors pay workers the prevailing wage and fringe benefits.

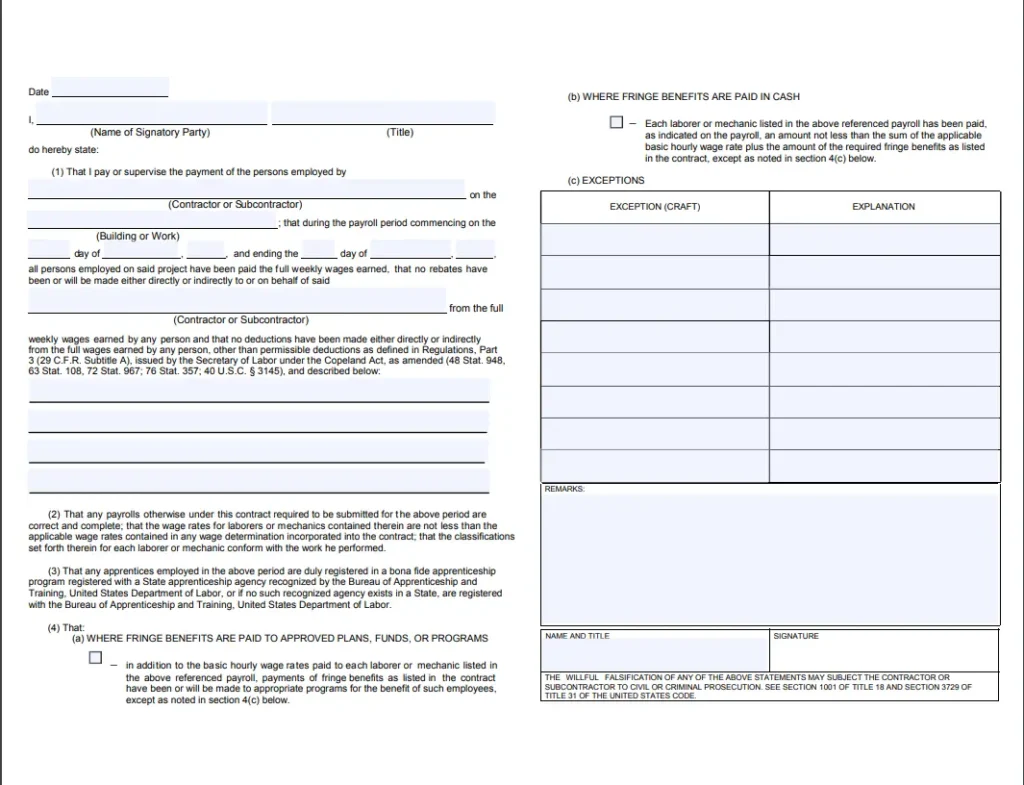

In addition to reporting employee hours and pay information, you must also fill out a “statement of compliance.” The statement of compliance affirms the information you submit is accurate.

| How long does it take to fill out Form WH-347? |

|---|

| The Department of Labor estimates it takes about 55 minutes to complete Form WH-347. This estimate includes reviewing instructions, gathering and maintaining payroll data, and completing and reviewing the WH-347 form. |

How to fill out Form WH-347

There are several sections you need to complete on Form WH-347. These include:

- Business information

- Contractor or subcontract information (name and address)

- Payroll number

- Week ending (aka the last day of the workweek)

- Project and location

- Project or contract number

- Employee information

- Employee names and identifying numbers (e.g., last four digits of SSN)

- Work classification

- Hours worked each day

- Total hours worked

- Rate of pay

- Gross amount earned

- Deductions (FICA, withholding tax, other)

- Total deductions

- Net wages paid for the week

- Statement of compliance

- Date

- Name and title of the individual signing the form

- Contractor or subcontractor

- Project information

- Payroll period

- Signature

Check out the following screenshots of Form WH-347 to see what the certified payroll report looks like. Page 1 is business and employee information. Page 2 is the statement of compliance.

Check out the U.S. Department of Labor’s website for detailed instructions on completing the form. You can view the PDF of Form WH-347 here.

Use payroll software to streamline certified payroll reporting

Filling out Form WH-347 can be overwhelming. It asks for detailed hour and pay information for each of your employees. But with payroll software, you can easily generate this information and fill out your certified payroll report.

Payroll software calculates employees’ gross wages, deductions, and net pay. The software stores this information and gives you an easy way to manage and view your payroll records through payroll reports.

You can use payroll reports to find the information you need to fill out Form WH-347, including your employees’:

- Personal information

- Hours worked each day and week

- Pay rate

- Gross amount earned

- FICA tax and other deductions

- Net wages

Look for a software solution that lets you pay employees weekly. Some payroll providers charge per payroll run, which can add up when you pay employees each week (52 times per year!). But others offer perks like unlimited payroll runs, which lets you run as many payrolls as you need for the same price.

Where to send certified payroll reports

Give completed reports to the federal or state agency representative in charge of the worksite.

If there isn’t a representative at the worksite, you must mail the report to the agency contracting for or financing the work. Send the report within seven days after the regular payment date.

For more information, consult the Department of Labor’s Frequently Asked Questions.

What is the penalty for failing to comply with certified payroll?

The government can assess penalties for contractors and subcontractors who do not comply with certified payroll reporting.

You may receive penalties for failing to submit certified payroll reports, submitting the report without signing it, or falsifying certified payrolls.

Penalties include:

- Withheld contract funds

- Fines

- Imprisonment of not more than 5 years

Keep in mind that the government can assess a combination of penalties.

Where to go for more information

Want more information on your certified payroll responsibilities? Check out the following resources from the U.S. Department of Labor.

- View Form WH-347 and its instructions

- Learn more about the Davis-Bacon and Related Acts

- Get answers to frequently asked questions about your responsibilities

Handling certified payroll at a glance

The “Davis-Bacon Act,” “prevailing wage,” and “certified payroll” are three terms that go together. If The Davis-Bacon Act applies to your business, you must pay employees the prevailing wage and handle certified payrolls to prove it.

Remember that not all businesses are required to comply with certified payroll. Contractors and subcontractors with a federal contract of over $2,000 for construction-related projects must complete certified payroll reports and pay employees weekly.

Fill out Form WH-347 and deliver it to the representative in charge of your worksite or mail it to the agency. You can use payroll software to help you run payroll and keep organized records for certified payroll reporting.

Need a better way to pay employees? You can pay employees in three simple steps with Patriot’s online payroll. When you need to fill out your certified payroll report, you can use Patriot’s comprehensive payroll reports to quickly pull up employee personal information, hours, gross pay, deductions, and net pay info. Start your free trial today!

This is not intended as legal advice; for more information, please click here.