Do you have a temporary or permanently remote workforce? If so, you may consider offering work-from-home reimbursement to help workers cover remote-related expenses.

And depending on your state, you might not have a choice.

Read on to learn what a work-from-home reimbursement covers, tax details, and state guidelines. And, find out how to set up your work-from-home reimbursement policy.

What is work-from-home reimbursement?

If COVID-19 forced you to move your employees out of the office and into their homes, you may have some questions. First of all … what exactly is a work-from-home reimbursement, anyway?

Work-from-home reimbursements allow employers to help cover some costs employees incur when they work remotely.

A remote work reimbursement may cover the following employee costs:

- Internet services

- Telephone service

- Desks and chairs

- Computers

- Equipment

In most cases, employers aren’t required to reimburse employees for remote-related expenses. Generally, these types of reimbursements are voluntary employee benefits that can boost productivity, engagement, and morale.

However, COVID-19 has forced many workers to telecommute. As a result, working from home has become a mandate rather than an employee choice.

And in these cases, some employers do have to provide these reimbursements.

Under the federal Fair Labor Standards Act (FLSA), employers must reimburse employees for expenses if the costs cause the employee’s hourly wage rate to drop below minimum wage. So, watch out if an employee’s wages are at or just above minimum wage—they could dip below if the employee has necessary expenses involved with working from home.

Some states (e.g., Illinois) also require employers to reimburse employees for necessary expenses they incur to perform their work. And in California, this may mean employers must provide remote employees with internet or cell phone reimbursements.

Reimbursements and taxes

Reimbursable doesn’t mean non-taxable when it comes to telecommuting expenses. So, do you have to withhold taxes on employee work-from-home reimbursements?

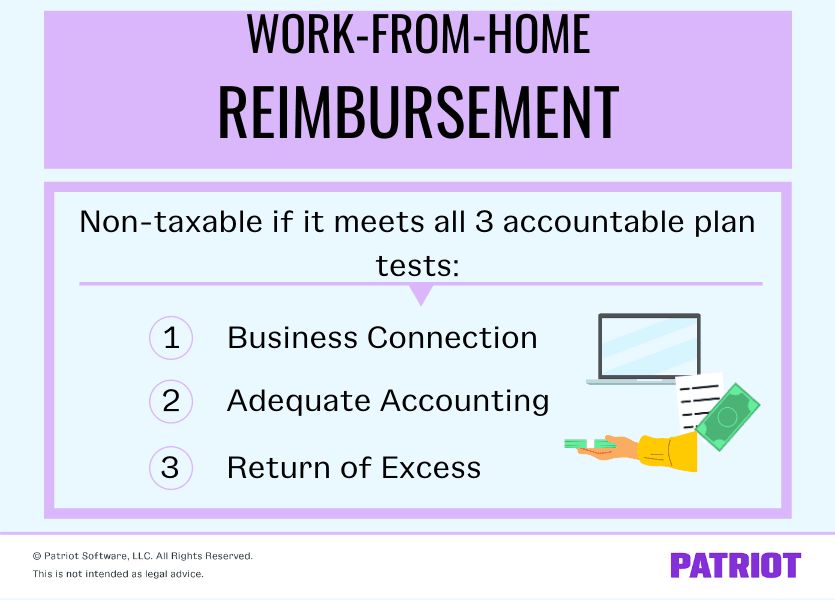

According to the IRS, a remote work reimbursement is only non-taxable if it meets all three accountable plan tests:

- Business connection

- Is the expense helpful and appropriate in the employee’s role? Is it an ordinary and necessary business expense?

- Adequate accounting

- Does the employee report the business expense to you within a reasonable period of time?

- Return of excess

- Does the employee return any excess reimbursements within a reasonable period of time?

If the expense fails any of these three tests, you must include the reimbursement in your employee’s gross income and withhold payroll taxes. And, include the amount on the employee’s Form W-2.

How to create your work-from-home reimbursement policy

Whether you choose to provide reimbursements for remote expenses or are required to, your policy should spell out everything to employees. Include your policy in your employee handbook so employees have easy access.

Map out the following three things in your policy:

- Which expenses the policy covers

- How employees can submit reimbursement requests

- How (and when) you will provide reimbursements

1. Specify which costs count

What employee expenses do you plan on covering? For example, will you cover any business expense that’s ordinary and necessary, or limit reimbursements to internet coverage?

You also need to think about how much of each expense you want to cover. For example, some employers choose to pay the percentage of an employee’s internet bill associated with business use.

This section of your internet and mobile phone reimbursement policy (and whatever other costs you want to cover) should detail:

- Eligible expenses for the work-from-home reimbursement

- Reimbursement limits

- Whether the cost must be ordinary, necessary, and helpful

2. Choose a reimbursement request process

Your policy should also explicitly detail the reimbursement request process. Include the following things in your policy:

- How the employee must request a reimbursement (e.g., submitting a form)

- The length of time the employee has to submit their request

- What supporting documents employees need to submit (e.g., receipts or bills)

- Whether the employee needs to ask before incurring the cost

3. Decide how to provide reimbursements

Last but not least, clearly let employees know how and when they can expect their reimbursements. Will you provide them as a lump sum or as the employee incurs them? Be consistent in how long it takes you to provide the reimbursement.

Need help running payroll for your employees? We can help. Patriot’s online payroll is fast, simple, and affordable. Plus, we offer free, U.S.-based support. Start your free trial today!

This is not intended as legal advice; for more information, please click here.