The greatest expense for small business owners is often payroll. Why? Because when you hire employees, you pay more than just their wages—you also pay payroll taxes, benefits contributions, and other miscellaneous expenses. So how much does an employee cost?

According to the Small Business Administration, an employee typically costs 1.25 – 1.4 times their salary. So an employee paid a $40,000 salary would cost $50,000 – $56,000.

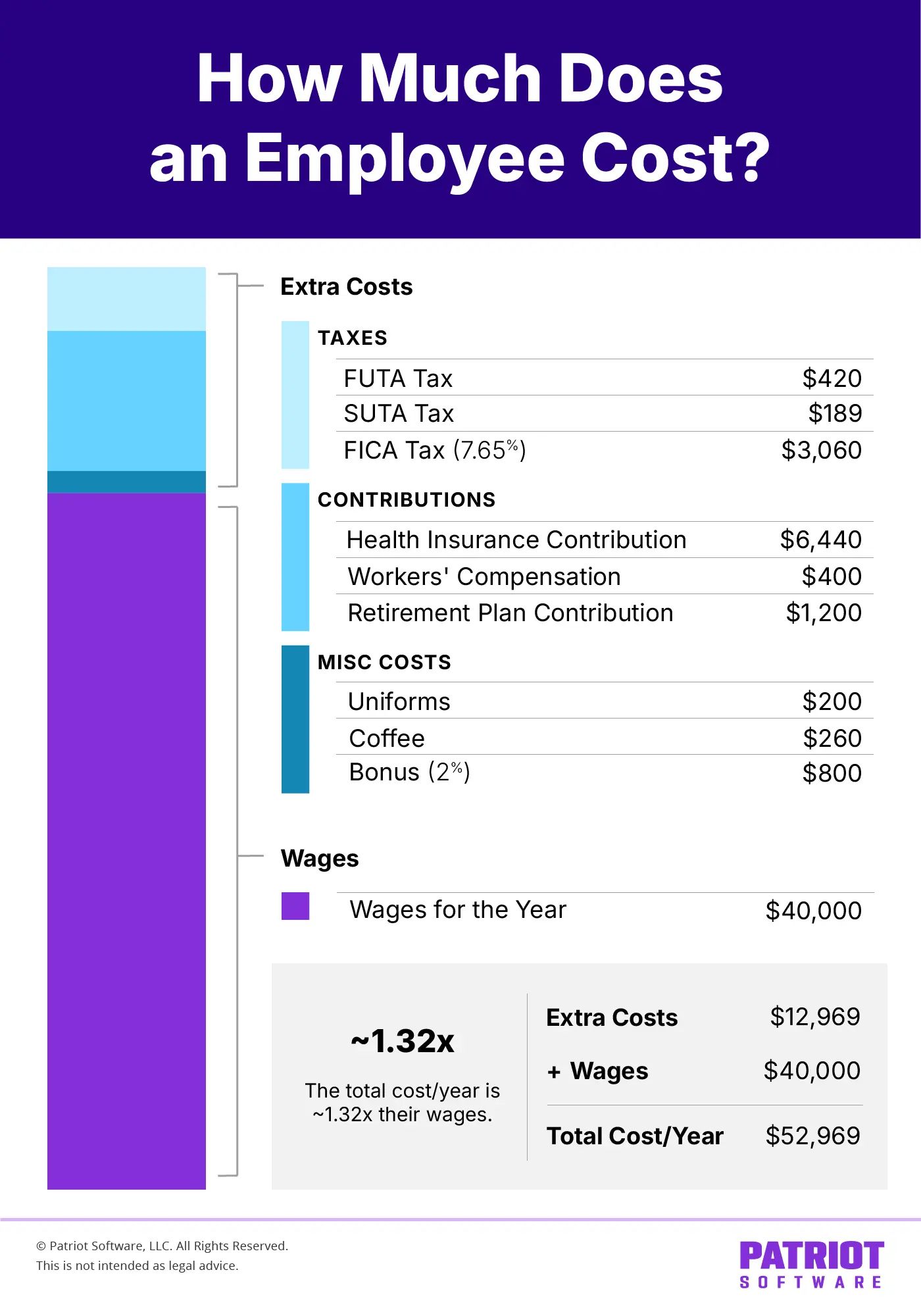

Before hiring your first employee or adding to your staff, understand the true cost of adding to your team. Use our infographic to find out how much an employee truly costs.

How much does it cost to have an employee?

An employee costs more than their salary or hourly wage. You also have to pay employer payroll taxes. You might have to pay portions of fringe benefits. And you might provide small extras for your employees, such as free coffee or snacks.

1. Employer payroll taxes

As an employer, you are responsible for paying the following payroll taxes:

- Employer portion of FICA tax: FICA tax consists of Social Security and Medicare taxes. Employers must pay a FICA tax rate of 7.65% and withhold an additional 7.65% from the employee’s wages.

- FUTA tax: Federal unemployment tax is 6% on the first $7,000 an employee earns. Most employers receive a FUTA tax credit of up to 5.4%, which reduces the FUTA tax rate to 0.6%.

- SUTA tax: State unemployment tax varies by state. Each state sets assigns a rate to employers based on factors like industry and past claims. And the state wage base varies.

Depending on your location, you might be responsible for additional state payroll taxes, such as paid family and medical leave premiums. Check with your state for more information.

2. Workers’ compensation insurance

In addition to payroll taxes, workers’ compensation insurance may be a mandatory expense if you have employees.

Workers’ compensation is a type of insurance that provides medical benefits and wage replacement if an employee gets sick or injured on the job. Most states require employers to obtain workers’ comp insurance.

3. Benefits

Want to offer your employees benefits, like health insurance and a retirement plan? If so, be prepared to tack on an additional expense.

Budget for benefit expenses like employer health insurance contributions, a 401(k) company match, and short-term disability insurance contributions.

4. Miscellaneous expenses

There may be additional expenses that come with having an employee, such as:

- Bonus payments

- Uniforms and uniform care

- Coffee and doughnuts (it adds up!)

- Employer-provided cell phones

Are you stressed about how quickly your expenses add up? You can reduce payroll costs by using affordable software, avoiding overstaffing, reducing overtime, and more.

How much does an employee cost? [Infographic]

How much do benefits cost per employee? What about miscellaneous expenses? Check out our infographic below for an example.

The infographic calculates the real cost of employing the example employee by using common extra expenses, like taxes and benefits.

The math behind the infographic

In this example, the employee earns $40,000 per year. Here’s how we got the numbers for the taxes, benefits, and miscellaneous costs:

- Employer portion of FICA tax: $3,060 ($40,000 X 7.65%)

- FUTA tax: $420 ($7,000 X 6%)

- Workers’ compensation: $400, using an estimate of $1 for every $100 in payroll [($40,000 / $100) X $1]

- SUTA tax: $189 (2.7% X $7,000; in this example, we used the Florida new employer SUTA tax rate of 2.7%, which is applied to the first $7,000 an employee earns)

- Health insurance: According to the Kaiser Family Foundation, the annual employer contribution for all health plans is $6,440 for single coverage

- Retirement plan: $1,200 employer match of 3% ($40,000 X 3%)

- Bonus: In this example, we gave the employee a 2% bonus, which is $800 ($40,000 X 2%)

- Uniforms: The employee’s uniforms cost $200 for the year

- Coffee: We estimated that the employee would consume two cups of coffee per day in the office (which, in our example, cost $0.50 per cup) for 260 workdays, for a total of $260

Although the employee earns $40,000 per year, the employer owes an additional $12,969 when adding up the above expenses.

So, how much does an employee cost? In this example, an employee earning $40,000 per year would actually cost $52,969 ($40,000 + $12,969). The employee is 32% more expensive than her salary [($52,969 – $40,000) / $40,000) X 100 = 32.42%].

…And don’t forget to estimate the cost of administering payroll! You can reduce your payroll burden with Patriot Software’s affordable and easy-to-use online payroll. Our customers save hundreds of dollars each year. See how when you sign up for a free trial!

This article has been updated from its original publication date of February 5, 2016.

This is not intended as legal advice; for more information, please click here.