Regular wages aren’t the only compensation you could provide to employees. You might also offer supplemental wages. Not sure what those are? Read on to learn what supplemental pay is and how it is taxed.

What are supplemental wages?

Supplemental pay is money that employees receive in addition to their regular wages. Supplemental wages include:

- Bonuses

- Commission pay

- Overtime pay

- Payments for accumulated sick leave

- Severance pay

- Awards

- Prizes

- Back pay

- Retro pay increases

- Payments for nondeductible moving expenses

You might give an employee bonus pay as a reward. Or, you might be required by law to provide supplemental wages if the employee puts in overtime. Whatever the case may be, providing supplemental wages isn’t uncommon in business.

If you decide to give employees supplemental wages, you can do so separately from regular wages or lump them together.

Handling supplemental wages can be confusing for business owners, especially if you are doing payroll by hand.

Supplemental tax

Because supplemental wages are non-regular wages, federal income tax withholding can be different than how you withhold federal income taxes on regular wages.

Withhold Social Security and Medicare taxes on supplemental wages the same way you would for regular wages.

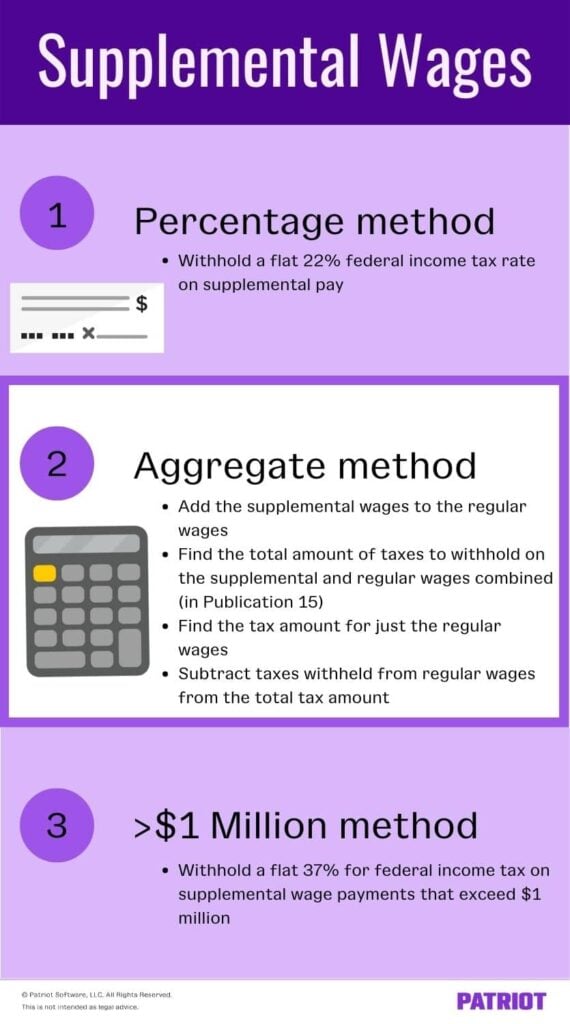

You can handle supplemental wage taxation for federal income tax in one of two ways:

- Withhold a flat percentage on supplemental wages (percentage method; recommended)

- Combine supplemental and regular wages (aggregate method)

There is also a different rate for employees who receive supplemental income totaling more than $1 million in one calendar year.

1. Withholding a flat percentage

You can withhold tax on supplemental wages using the percentage method. The federal supplemental tax rate is 22%.

Use this method if you already withheld income tax from the employee’s regular wages.

This is the easiest method of dealing with taxes on supplemental wage payments. Simply withhold 22% of the employee’s supplemental wage for federal income tax.

| Supplemental Tax Rate: 22% |

|---|

Because the taxes on the supplemental and regular wages are treated separately, withhold taxes on the employee’s regular wages like you normally would.

Let’s say you give an employee a bonus of $700. You would withhold $154 for federal income tax using the flat supplemental tax rate of 22% ($700 X 0.22 = $154).

2. Combining supplemental pay and regular wages

The process of combining wages for tax withholding varies depending on whether you paid an employee their regular and supplemental wages concurrently or separately.

You will not use the supplemental tax rate if using this method.

Concurrent payment

If you pay an employee their regular and supplemental wages together, tax withholding is a bit easier.

Simply add the wages together and withhold taxes on them. Find the employee’s tax bracket using the income tax withholding tables in Publication 15, the employee’s Form W-4 information, how much they are paid, their filing status, and the pay frequency.

Employees with a pre-2020 Form W-4 on file have claimed withholding allowances on the form. The number of claimed allowances determines their withholding.

Separate payment

If you pay an employee their supplemental wages separately from their regular wages, you will need to go a step further.

After adding together their regular and supplemental wages and finding the tax liability on the combined amount, you must subtract the tax liability for just the regular wages. You are then left with the amount of the supplemental tax.

3. Handling supplemental wages greater than $1 million

If an employee exceeds the $1 million dollar threshold for supplemental wages earned, do not combine supplemental and regular wages. And, do not withhold at the 22% federal supplemental tax rate.

This situation isn’t very common, but if an employee receives supplemental wages that are greater than $1 million, you must withhold the excess at a rate of 37%. Only withhold 37% on the excess money, not the supplemental wages the employee earns before $1 million.

Remember, add up all supplemental pay (bonuses, commissions, overtime, etc.) when calculating the employee’s total supplemental wages for the year.

For example, an employee earns supplemental wages totaling $1,150,000. $150,000 of their supplemental wages are in excess of $1 million, so you must use the special 37% tax rate. You would withhold $55,500 from the employee’s $150,000 excess for federal income tax ($150,000 X 0.37 = $55,500).

Supplemental tax rate by state

There are also state supplemental tax rates. This is an additional percentage you must withhold on the employee’s wages for state income tax.

If your employees work in a state with state income tax, you need to know how to handle supplemental pay. Contact your state for more information.

This article has been updated from its original publication date of April 4, 2018.

This is not intended as legal advice; for more information, please click here.