For business owners in most states, collecting and remitting sales tax is part of the job description. But on select dates throughout the year, your customers can take advantage of a sales tax holiday.

Read More 2025 Sales Tax Holiday Dates: Ready, Set, Go! Mark Your CalendarsBusiness Taxes Articles

Business Taxes - Tips, Training, and News

How to Calculate Sales Tax to Meet Your Small Business Requirements

For many businesses, collecting sales tax is a mandatory part of selling goods and providing services. After collecting sales tax from customers, you are responsible for remitting the tax to your state or local government. But before you start collecting, you need to know how to calculate sales tax.

Read More How to Calculate Sales Tax to Meet Your Small Business Requirements

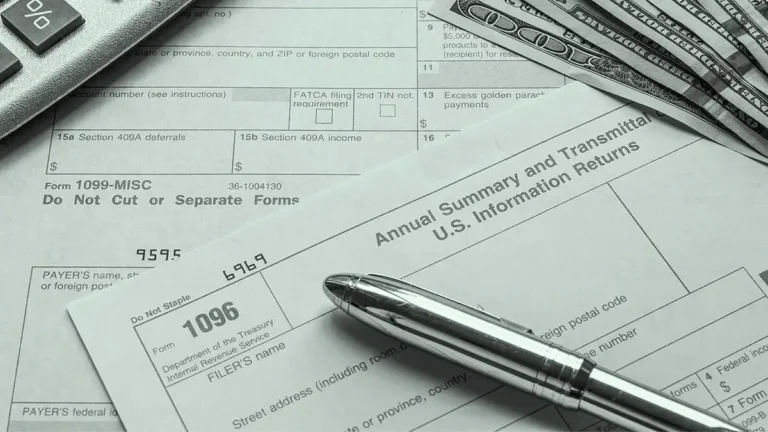

Form 1096: What it Is, Filing Instructions, and More

Sometimes, you need to hire workers who aren’t employees to complete certain tasks at your business. When you hire contractors or vendors, you must prepare Forms 1099-NEC or 1099-MISC so they can accurately file their personal tax returns. You also need to submit Form 1096 with the Forms 1099 you send to the IRS.

Read More Form 1096: What it Is, Filing Instructions, and More

Throwback Rule: Does Your State Have a Throwout or Throwback Rule for Corporations?

When it comes to company taxation, each state has its own set of laws for businesses. And depending on your type of business structure, you might be subject to different types of laws, such as the throwback rule.

Read More Throwback Rule: Does Your State Have a Throwout or Throwback Rule for Corporations?

Business Mileage Deduction 101

Miles spent driving to meet clients, going to an office supply store, and depositing a customer’s check at the bank can add up. If you use a vehicle for small business purposes, you might qualify for a business mileage deduction from the IRS.

Read More Business Mileage Deduction 101

What to Do If You Receive an IRS Notice (Besides Panic)

Receiving a tax notice from the IRS can be scary. But, there are basic steps that you can take when responding to IRS notice.

Read More What to Do If You Receive an IRS Notice (Besides Panic)

How Long to Keep Business Records [+ Best Practices]

Picture this: You own a small restaurant. One day, you receive an IRS notice—you’re being audited. Do you A) Panic or B) Calmly review your business records? If you know how long to keep business records (and which ones to keep), you’ll have the supporting documents needed to back up your tax return claims.

Read More How Long to Keep Business Records [+ Best Practices]

What Does Self-employed Mean?

You run your own business, but are you considered self-employed? The definition of self-employment can be confusing. What does self-employment mean? Find out below.

Read More What Does Self-employed Mean?

Are Employee Wages Tax Deductible If You’re a Sole Proprietor?

Small business tax deductions provide a great way for business owners to offset expenses and lower tax bills. And in business, expenses—especially your employees on payroll—add up quickly. Are employee wages tax deductible?

Read More Are Employee Wages Tax Deductible If You’re a Sole Proprietor?

Software Tax Deduction: Can You Deduct the Cost of Software for Your Business?

Millions of businesses use at least one small business software platform to do everything from running payroll to managing customer relationships. Software can simplify processes, save time, and ensure accuracy. But the more systems you use, the greater your costs. Can you take a software tax deduction to offset your expenses?

Read More Software Tax Deduction: Can You Deduct the Cost of Software for Your Business?