Are you thinking about offering retirement plans at your small business? There are a lot of retirement options to choose from. Two common retirement plans for employees are individual retirement arrangement/account (IRA) plans and 401(k) plans.

Read More Roth 401(k) vs. Roth IRA: What Is the Difference?Human Resources Articles

Human Resources - Tips, Training, and News

Most popular blog categories

Types of 401(k) Plans: Traditional, Roth, and More

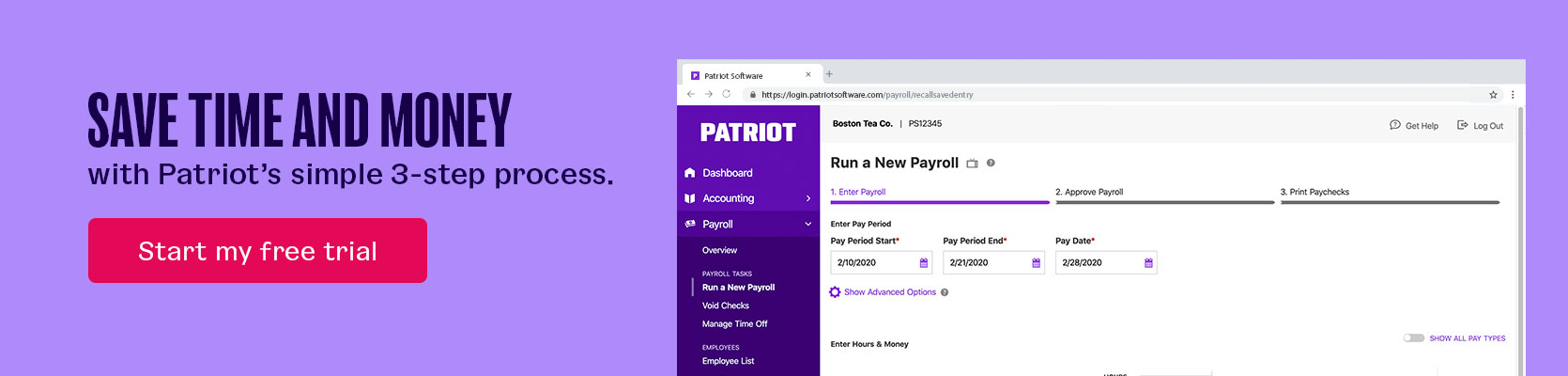

Here’s the scoop: 72% of private industry workers have access to employer-provided retirement plans. Do yours? If you don’t offer employees a small business retirement plan, like a 401(k), it might be time to hop on the bandwagon. Read on to learn about the types of 401(k) plans to choose from. About 401(k) plans A […]

Read More Types of 401(k) Plans: Traditional, Roth, and More

What Are Excepted Benefits, and Should You Offer Them to Employees?

Navigating through the waters of health insurance coverage is tricky. You might be wondering, Do employers have to offer health insurance? Although the Affordable Care Act (ACA) requires employers with 50 or more full-time equivalent employees to provide health insurance, no employer has to offer excepted benefits.

Read More What Are Excepted Benefits, and Should You Offer Them to Employees?

QSEHRA Plan: Health Insurance Alternative for Qualifying Small Employers

Do employers have to offer health insurance? Under the Affordable Care Act, you must provide health insurance if you have 50 or more full-time equivalent employees. If this requirement doesn’t apply to you, you might decide to establish a QSEHRA plan.

Read More QSEHRA Plan: Health Insurance Alternative for Qualifying Small Employers

Are Payroll Deductions for Health Insurance Pre-Tax? The Answer You Need to Know

Creating an employee benefits package can help attract and retain talent. But providing health insurance benefits to your employees can leave you with questions. If you have your employees contribute to their premiums, you have to know how to deduct the cost from their gross pay. But, are payroll deductions for health insurance pre-tax? Read […]

Read More Are Payroll Deductions for Health Insurance Pre-Tax? The Answer You Need to Know

Can Employers Reimburse Employees for Health Insurance? Answers and Plan Options

Let’s face it: Health insurance is expensive. The average employer health insurance premium contribution—per employee—is nearly $6,000 (single) and nearly $15,000 (family) annually.

Read More Can Employers Reimburse Employees for Health Insurance? Answers and Plan Options

Small Business Health Insurance Options: Which (If Any) Will You Pick?

Thinking about offering employer-sponsored health insurance? Sure, you could offer traditional group health insurance to your employees, but that’s not your only choice. There are several small business health insurance options you can choose from.

Read More Small Business Health Insurance Options: Which (If Any) Will You Pick?

A Section 125 Plan: The Overview for Employers

Offering competitive benefits attracts, satisfies, and retains top talent. Benefits include everything from retirement plans to health insurance coverage. When you dive into different small business employee benefits, you might consider a section 125 plan. But, what is a section 125 plan? Is it a cafeteria plan? Are section 125 plans pre-tax health insurance? Keep […]

Read More A Section 125 Plan: The Overview for Employers

What Is an HSA? 2025 HSA Contribution Limits and More

Most businesses offer employee benefits in addition to regular wages. Common employee benefits can range from different insurance options to types of retirement plans. Some employees have the option of opening an HSA. What is an HSA?

Read More What Is an HSA? 2025 HSA Contribution Limits and More

FSA vs. HSA: What’s the Difference? (+ Quick Reference Chart)

When it comes to health coverage, there are a lot of options out there. FSAs and HSAs are healthcare plans that cover medically-related expenses not included under a traditional health plan. Do you know the difference between an FSA vs. HSA?

Read More FSA vs. HSA: What’s the Difference? (+ Quick Reference Chart)