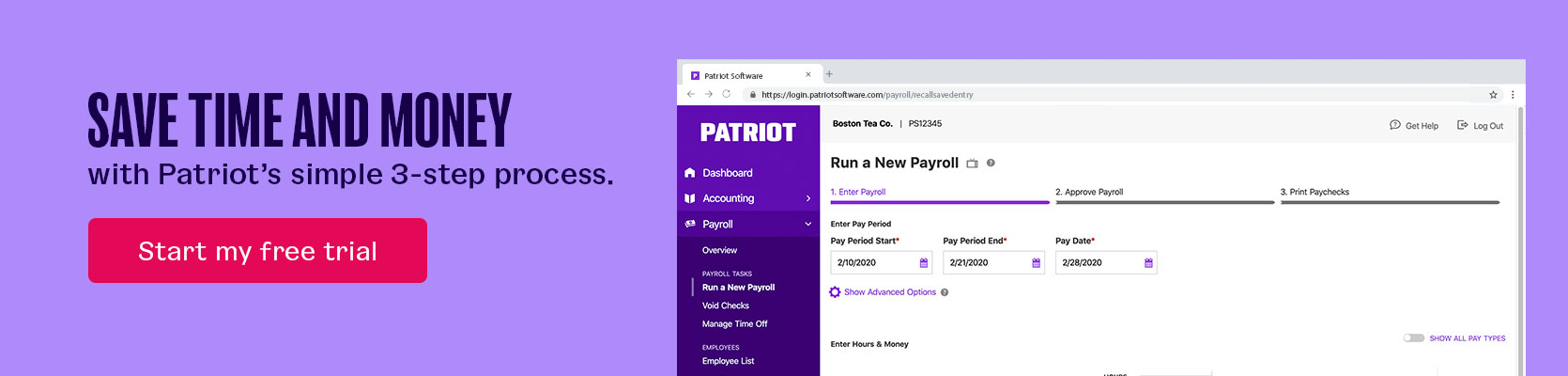

Part of your title as “employer” also includes “payroll processor.” When you hire employees, you have to add them to payroll, withhold the proper taxes, and pay employees. It’s all part of the job. But if you’re new to this employer role, you may not be exactly sure how to process payroll. We’ve written down […]

Read More How to Process Payroll in 8 Straightforward StepsPayroll Taxes Articles

Payroll Taxes - Tips, Training, and News

Most popular blog categories

Alabama Overtime Tax Law: Tax Break for Employees, Required Reporting for Employers

Understand the new Alabama overtime tax law that exempts employees’ overtime earnings from state income tax. Get the details and reporting requirements for businesses.

Read More Alabama Overtime Tax Law: Tax Break for Employees, Required Reporting for Employers

How to File Employee Taxes (Federal Income, Social Security, & More)

You’re part business owner, part marketer, and part … payroll tax filing extraordinaire. And being a payroll tax filing extraordinaire requires that you know how to file employee taxes.

Read More How to File Employee Taxes (Federal Income, Social Security, & More)

ERC Voluntary Disclosure Program Reopened, Giving Discounts on Questionable Claims

The employee retention credit (ERC) was a lifeline for small businesses struggling to stay open during the pandemic. But bad actors quickly pounced on the opportunity. “ERC mills” began aggressive marketing campaigns advising employers to apply (even if they didn’t qualify) and collecting hefty upfront fees.

Read More ERC Voluntary Disclosure Program Reopened, Giving Discounts on Questionable Claims

What Is My State Unemployment Tax Rate? [Chart]

Running payroll means staying on top of your employment tax responsibilities. In addition to withholding income and payroll taxes from employee wages, you must contribute employer taxes. Unlike some other taxes, state unemployment taxes do not have a standard rate. Read on to answer, What is my state unemployment tax rate?

Read More What Is My State Unemployment Tax Rate? [Chart]

OASDI Tax: Old-Age, Survivors, and Disability Insurance (OASDI) Tax Deductions

Tax withholding is an essential piece of the payroll puzzle. One of the taxes you must withhold from employee wages is the Old-Age, Survivors, and Disability Insurance (OASDI) tax. You must also contribute an employer portion of the OASDI tax. OASDI tax is more commonly referred to as Social Security tax.

Read More OASDI Tax: Old-Age, Survivors, and Disability Insurance (OASDI) Tax Deductions

What Is FICA Tax, and How Much Is It?

As an employer, you’re in charge of paying your employees … and handling those pesky employment taxes. One of the taxes you need to calculate and withhold is a payroll tax known as FICA. What is FICA tax?

Read More What Is FICA Tax, and How Much Is It?

What Is an Employee Assistance Program (EAP), and Is it Taxable?

Benefits matter to 81% of employees, which means your benefits package is an important recruitment and retention tool. From traditional benefits, like health insurance, to newer benefits, like student loan repayment, you’re always looking for the next best thing. Have you heard of employee assistance program (EAP) benefits? What is EAP, exactly?

Read More What Is an Employee Assistance Program (EAP), and Is it Taxable?

What Is the Difference Between Gross and Net Pay?

Running payroll can be confusing. Although it’s natural to have payroll questions when starting out, you can’t afford to get tripped up when it comes to gross vs. net pay. Knowing the difference between gross and net pay impacts employee wages, payroll withholdings, recordkeeping, and even employer laws.

Read More What Is the Difference Between Gross and Net Pay?

How to Calculate Net Pay: Step-by-step Guide and Examples

Employee salary: $50,000 a year. But you know that’s not what they’re walking away with. Between taxes and benefit deductions, the employee’s take-home pay could be far from the $50,000 sticker price (cue the sad violin). Learn how to calculate net pay to find your employees’ take-home wages.

Read More How to Calculate Net Pay: Step-by-step Guide and Examples